Evergrande Debt Ratio

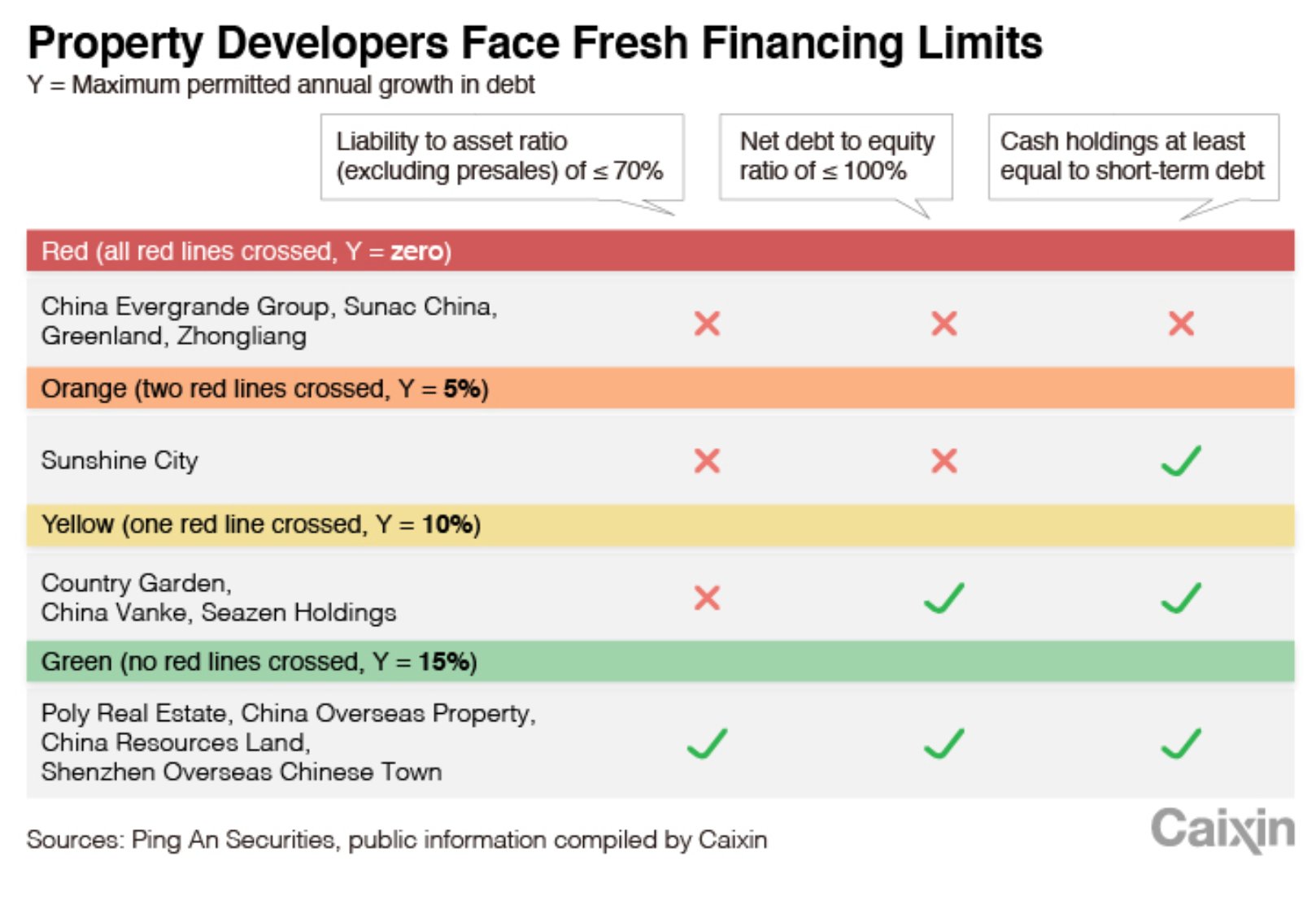

Evergrande Chinas wobbling. The three red lines state that developers must have a liability-to-asset ratio of less than 70 percent.

Adam Tooze On Twitter Chinese Regulators Are Testing New Regs For Top Real Estate Firms Including Evergrande Sunac Country Garden Red Lines A Liability To Asset Ratio 70 Net Debt To Equity Ratio Of Under

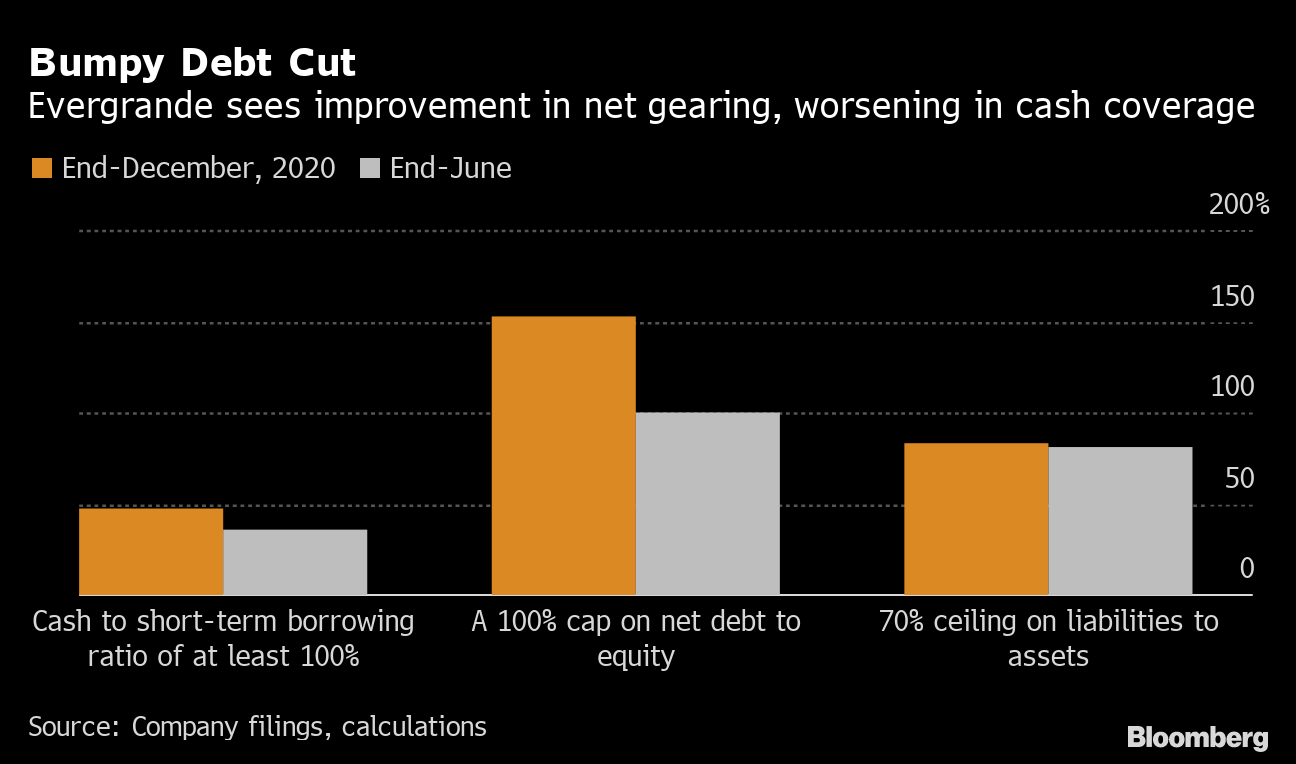

Evergrande accelerated its debt-reduction efforts last year after regulators introduced caps on three debt ratios dubbed the three red lines.

Evergrande debt ratio. And a cash-to-short-term debt ratio. The central bank names Evergrande. The troubles of Chinese conglomerate Evergrande have dominated headlines in recent days after it warned once again that it could default on its astronomical debt.

Evergrande vows to cut its debt for the first time aiming to slash net gearing ratio to 70 by June 2020 from 240 in June 2017.

China Evergrande S Snowballing Debt Crisis

China Evergrande Profit Drops As Developer Seeks To Ease Cash Crunch Bloomberg

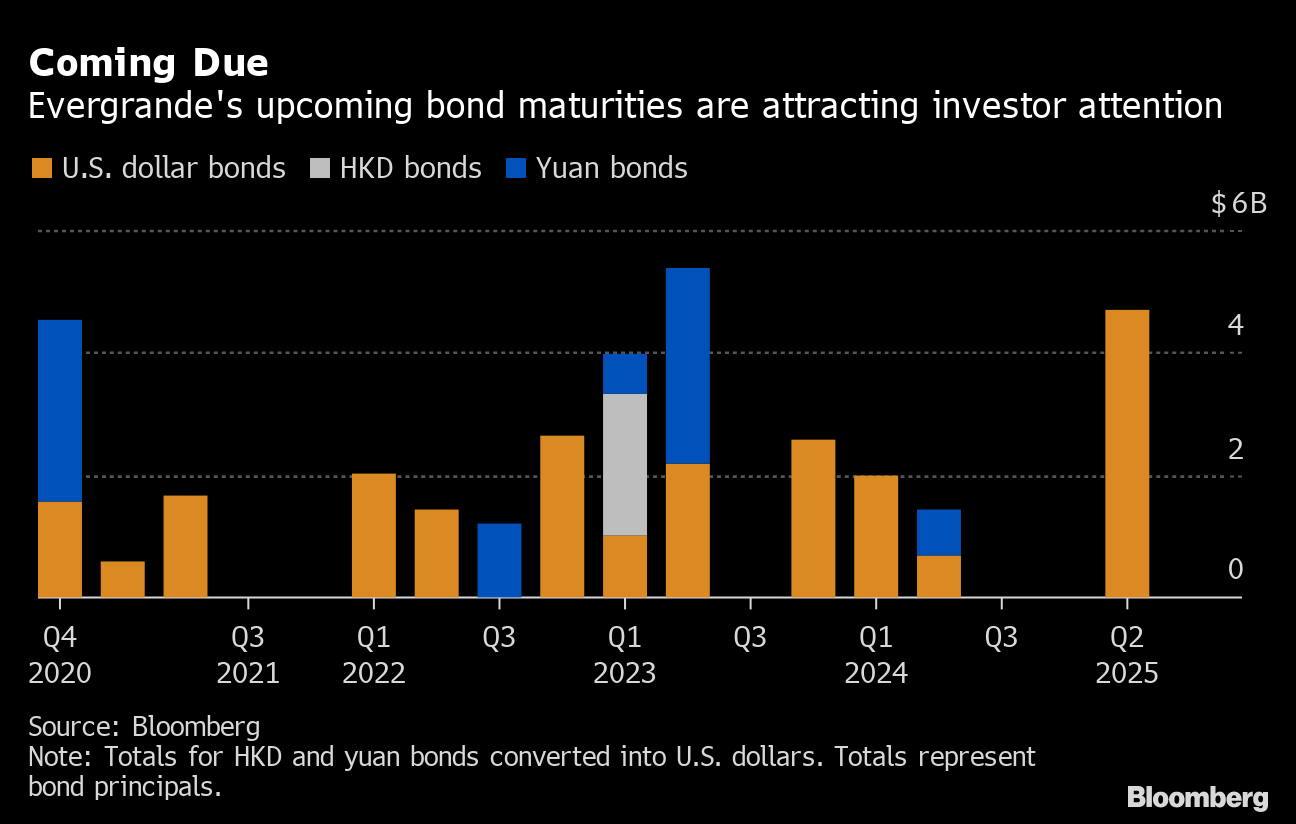

Evergrande Squeezed By 53 Billion Of Maturities In Tough Market

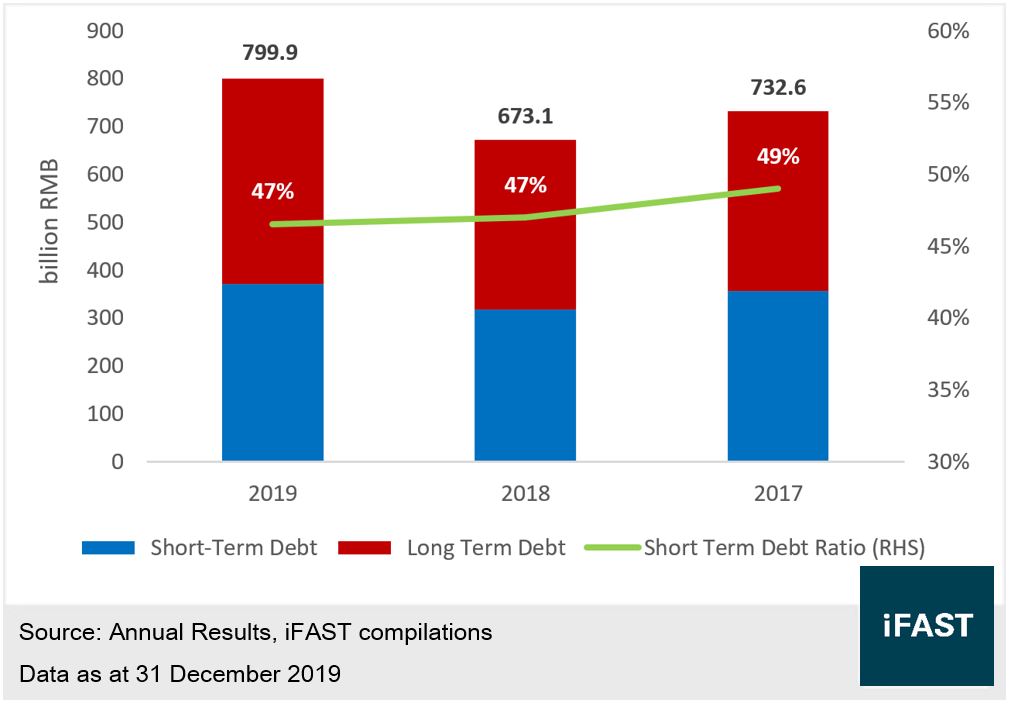

Evergrande Entering The Era Of Deleveraging Bondsupermart

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

0 Response to "Evergrande Debt Ratio"

Post a Comment